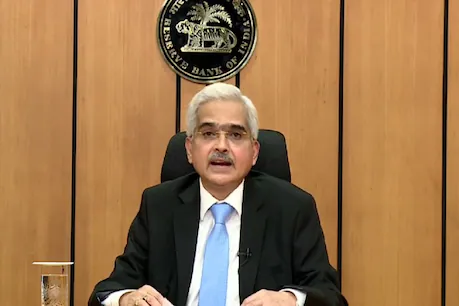

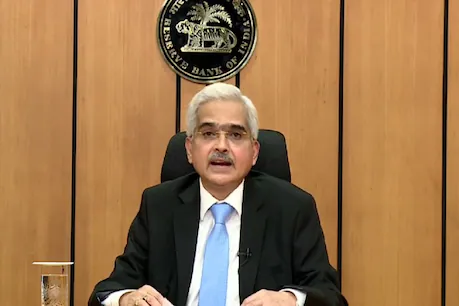

New Delhi. Reserve Bank of India (RBI) Governor Shaktikant Das (RBI Governor Shaktikant Das) addressed the press conference between the second wave of corona today. The RBI Governor said that the second wave of Corona is more deadly than before. Due to various restrictions in many states, it will have a serious impact on the economy. The RBI is monitoring this situation. Das said that after the first wave of Corona, the economy performed very well and there was good recovery. Understand what Shaktikanta Das said through these key points….

A plan of Rs 50,000 crore on-tap liquidity window has been launched with a period of up to 3 years at the repo rate by 31 March 2022. Under the scheme, banks can support institutions including vaccine manufacturers, medical facilities, hospitals and patients. The second phase of the purchase of 35000 crore worth of securities securities will be started on 20 May.

Banks are being encouraged so that loans can be increased rapidly in vulnerable areas. Banks will create a COVID loan book in their balance sheet and can give more money at reverse repo rate equal to RBI’s Covid book. – Borrowers up to Rs 25 crore, which were not restructured earlier, will be considered for restructuring by September 30, 2021. Resolution 1.0 can be extended to two years. –

Small finance banks lending to MFIs are to be classified as priority sector. Small finance banks will give priority to lending to microfinance institutions (MFIs) as it will be in the midst of the COVID-19 epidemic. For small finance banks, this facility will be available by 31 March 2022.

According to experts, RBI’s efforts will increase the impact of capital and cash in the market. Banks will give more money to people by giving more loans and putting money in the market by RBI. Hence, there will be a possibility of increase in demand. Small and medium industries going through the capital crisis will also get support. Because of this, it will help in dealing with the Corona crisis. Various restrictions are particularly harming small and medium industries. That is why the government wants them to get maximum help. Also, you can get relief in loan repair.

The Governor of the Reserve Bank of India said that the situation has changed and it has turned from the low rungs of strong economic recovery to facing a new crisis. The destructive speed with which the virus is afflicting people must be countered with the same swift and comprehensive action that has been thought, tested and tested. With this, various sections including the most vulnerable can be reached.

Also Read : BJP MAY NOT HAVE GOT POWER IN BENGAL, BUT IT HAS NOT LOST